How to Meet Short Term Disability Requirements?

Looking for trusted legal experts to handle your case? Whether it’s a complex claim or a personal issue, FreeLegalCaseReview offers free consultations and expert advice tailored to your needs. Or call us directly at 833-248-4565.

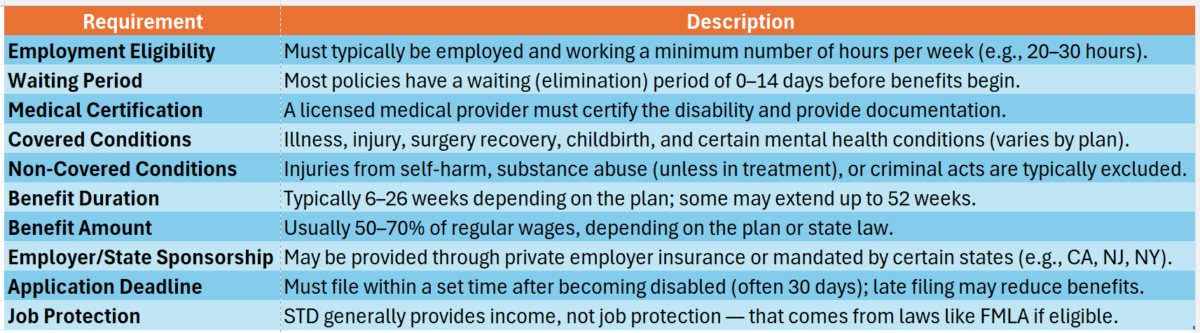

Understanding Short Term Disability Requirements is crucial for anyone facing health challenges that hinder their ability to work. Knowing what you need to qualify can make a significant difference in your financial stability during tough times.

To meet Short Term Disability Requirements, you typically need to provide medical documentation that supports your claim. This includes a diagnosis from a healthcare provider and proof that your condition prevents you from performing your job duties.

What Conditions Automatically Qualify You For Disability?

Some conditions that may automatically qualify you for disability include:

- Severe injuries or surgeries

- Chronic illnesses like cancer or heart disease

- Mental health disorders such as severe depression or anxiety If you have one of these conditions, it’s essential to gather all necessary medical records to support your claim.

Social Security Disability Rules After Age 50

If you’re over 50, Social Security Disability rules can be more lenient. They recognize that older workers may face more challenges in finding new employment due to health issues. This can be beneficial when proving your case for short-term disability.

Are You Eligible? Key Factors in Meeting Short Term Disability Requirements

Understanding how to meet short-term disability requirements is crucial for anyone facing health challenges. It can be overwhelming to navigate the rules, but knowing what qualifies you can make the process smoother. Let’s break it down together!

Key Factors to Consider:

- Employment Status: You typically need to be employed and have a certain amount of work hours to qualify.

- Medical Documentation: Your doctor must provide clear evidence of your condition. This is essential!

- Duration of Disability: Short-term disability usually covers a limited time, often up to six months. Make sure your condition aligns with this timeframe.

What Conditions Automatically Qualify You For Disability?

Some conditions are more straightforward when it comes to qualifying. These include:

- Severe injuries

- Major surgeries

- Chronic illnesses like cancer or heart disease

Understanding these factors can help you determine if you meet the short-term disability requirements. If you’re over 50, remember that Social Security Disability rules may also apply, offering additional support for those facing long-term challenges.

Gathering Necessary Documentation for Short Term Disability Claims

Gathering the right documentation is crucial when navigating Short Term Disability Requirements. It can feel overwhelming, but having everything in order can make the process smoother. This section will guide you through the essential steps to ensure your claim is successful.

Key Documents to Collect

To meet the Short Term Disability Requirements, you’ll need several important documents. Here’s a quick list to help you get started:

- Medical Records: These should detail your condition and treatment.

- Employer Documentation: This includes your job description and any relevant policies.

- Claim Forms: Ensure these are filled out completely and accurately.

Understanding Qualifying Conditions

You might wonder, What Conditions Automatically Qualify You For Disability? Common conditions include severe injuries, chronic illnesses, and mental health issues. Knowing this can help you gather the right evidence to support your claim.

Additional Considerations

If you’re over 50, you might be curious about the Social Security Disability Rules After Age 50. These rules can be more lenient, recognizing that older adults may face unique challenges in the workplace. Be sure to highlight any age-related factors in your documentation.

The Application Process: Steps to Ensure You Meet Short Term Disability Requirements

Navigating the world of short-term disability can feel overwhelming, especially when you’re unsure about the requirements. Understanding how to meet short-term disability requirements is crucial for anyone facing a temporary inability to work due to health issues. This knowledge not only helps you secure the benefits you need but also eases the stress during a challenging time.

Gather Necessary Documentation

To start, collect all relevant medical records and documents. This includes:

- Doctor’s notes

- Treatment plans

- Any test results These documents are vital in proving your condition and its impact on your ability to work.

Understand What Conditions Automatically Qualify You For Disability

Certain conditions, like severe injuries or chronic illnesses, may automatically qualify you for disability benefits. Knowing these can save you time and effort in your application process. Researching these conditions can give you a clearer picture of your eligibility.

Follow Social Security Disability Rules After Age 50

If you’re over 50, be aware that Social Security has specific rules that may apply to you. These rules can make it easier to qualify for benefits, so ensure you understand how they work. This knowledge can be a game-changer in your application process.

Common Mistakes to Avoid When Applying for Short Term Disability

Applying for short-term disability can feel overwhelming, especially when you’re already dealing with health issues. Understanding how to meet short-term disability requirements is crucial to ensure you receive the support you need. Unfortunately, many applicants make common mistakes that can delay or even deny their claims.

Not Providing Enough Medical Evidence

One of the biggest pitfalls is failing to submit sufficient medical documentation. Always include detailed reports from your healthcare provider that clearly outline your condition. This helps demonstrate that you meet the short term disability requirements necessary for approval.

Ignoring the Application Instructions

Each insurance provider has specific guidelines. Make sure to read and follow the instructions carefully. Missing a form or providing incorrect information can lead to a denial. Remember, understanding what conditions automatically qualify you for disability can also guide your application process.

Waiting Too Long to Apply

Time is of the essence! Delaying your application can complicate your case. If you’re unsure about your eligibility, reach out to your provider. Knowing the social security disability rules after age 50 can also help you understand your rights and options better.

Ready to connect with top legal professionals? Get immediate support— Call us at 833-248-4565.

How to Appeal a Denied Short Term Disability Claim

When your short-term disability claim gets denied, it can feel like a punch to the gut. Understanding how to meet short-term disability requirements is crucial. Not only does it help you navigate the appeal process, but it also ensures you get the support you need during tough times.

Understand the Reasons for Denial

First, find out why your claim was denied. Common reasons include insufficient medical evidence or not meeting the short term disability requirements. Knowing the specific reasons can guide your appeal effectively.

Gather Necessary Documentation

Next, collect all relevant documents. This includes medical records, treatment plans, and any other evidence that supports your claim. If you’re unsure what conditions automatically qualify you for disability, consult a healthcare professional for clarity.

Submit Your Appeal

Finally, submit your appeal promptly. Include a cover letter explaining why you believe the denial was incorrect. Remember, if you’re over 50, be aware of the Social Security disability rules after age 50, as they may impact your case.

Read Also: What Conditions Automatically Qualify You for Disability?

The Role of Healthcare Providers in Meeting Short Term Disability Requirements

When it comes to navigating the world of short-term disability, understanding how to meet short-term disability requirements is crucial. Your healthcare provider plays a pivotal role in this process. They not only diagnose your condition but also provide the necessary documentation to support your claim. Without their input, you might find it challenging to secure the benefits you need during recovery.

The Role of Healthcare Providers

Healthcare providers can help you in several ways:

- Diagnosis: They assess your health and determine if your condition qualifies under short-term disability requirements.

- Documentation: A detailed medical report from your doctor can significantly strengthen your claim. This report should outline your condition and how it impacts your ability to work.

- Ongoing Support: Regular check-ups and updates from your healthcare provider can help track your progress and adjust your treatment plan as needed.

What Conditions Automatically Qualify You For Disability?

Some conditions may automatically qualify you for disability benefits. These can include:

- Severe injuries

- Chronic illnesses like cancer or heart disease

- Mental health disorders

Understanding these conditions can help you and your healthcare provider determine the best course of action. Remember, if you’re over 50, Social Security disability rules may also apply, providing additional support for those who need it most.

How FreeLegalCaseReview Can Help You Navigate Short Term Disability Requirements

Navigating short-term disability requirements can be daunting, especially when health issues arise. Understanding what you need to qualify is essential for your recovery and financial stability. That’s where FreeLegalCaseReview steps in to assist you throughout the process.

Understanding the Basics

At FreeLegalCaseReview, we simplify short-term disability requirements into clear steps. Knowing which conditions automatically qualify you for disability, such as severe injuries or chronic illnesses, allows you to focus on healing rather than paperwork.

Expert Guidance

Our dedicated team is ready to guide you through the entire process. We help you gather necessary documentation and clarify Social Security disability rules after age 50, ensuring you have the most accurate information to support your claim as requirements may change with age.

Personalized Support

We provide personalized support tailored to your unique situation. Whether you’re uncertain about eligibility or need assistance with forms, our experts are just a call away, helping you recover without added stress.

Resources at Your Fingertips

We offer a wealth of resources, including articles and checklists, to help you understand short-term disability requirements, enabling informed decisions about your health and finances.

Don’t wait to secure the legal representation you deserve. Visit FreeLegalCaseReview today for free quotes and tailored guidance, or call 833-248-4565 for immediate assistance.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

1. What is short term disability insurance?

Short term disability insurance provides income replacement if you are temporarily unable to work due to illness, injury, or a medical condition not related to work.

2. What are the general requirements to qualify for short term disability?

You typically need to be employed, have worked a certain number of hours, and have a medical condition that prevents you from working for a minimum amount of time (often 7 days or more). Documentation from a licensed medical provider is usually required.

3. How long do I need to be employed to qualify for short term disability?

This depends on the policy. Some employers require 3–12 months of employment before benefits begin. Check with your HR department or policy provider.

4. What medical conditions qualify for short term disability?

Qualifying conditions can include surgery recovery, pregnancy, serious illness, mental health issues, or non-work-related injuries. The key requirement is that the condition prevents you from doing your job temporarily.

5. How do I apply for short term disability benefits?

Applications are typically submitted through your employer or directly to the insurance provider. You will need to complete forms, provide medical certification, and possibly include employment verification.

6. How long do short term disability benefits last?

Coverage typically lasts between 3 to 6 months, depending on the policy. Some plans may extend up to 12 months.