What If My Disability Check Is Not Enough?

Looking for trusted legal experts to handle your case? Whether it’s a complex claim or a personal issue, FreeLegalCaseReview offers free consultations and expert advice tailored to your needs. Or call us directly at 833-248-4565.

When you rely on your disability check, it can be tough to make ends meet. Many people find that their monthly payments simply don’t cover all their expenses. Understanding this reality is crucial because it can help you explore options and find solutions. If you’re thinking, My Disability Check Is Not Enough, you’re not alone.

Why It Matters

Many individuals depend on permanent disability payments for their livelihood. However, these payments often fall short of covering basic needs like rent, food, and medical bills. This gap can lead to stress and anxiety, making it essential to address the issue head-on.

What Can You Do?

If your disability check isn’t enough, consider these options:

- Budget Wisely: Track your spending to identify areas where you can save.

- Seek Additional Income: Look for part-time work or freelance opportunities that accommodate your situation.

- Explore Assistance Programs: Research local and federal programs that can provide additional support.

Exploring Additional Income Sources for Disabled Individuals

When you rely on your disability check, it can be tough if you find that it isn’t enough to cover your basic needs. Many individuals face this challenge, and it’s important to explore additional income sources. Understanding your options can help you feel more secure and empowered.

Consider Part-Time Work

Finding a part-time job can be a great way to supplement your income. Many companies offer flexible hours, which can be perfect for those receiving permanent disability payments. Look for roles that match your skills and interests, and don’t hesitate to ask about remote work options.

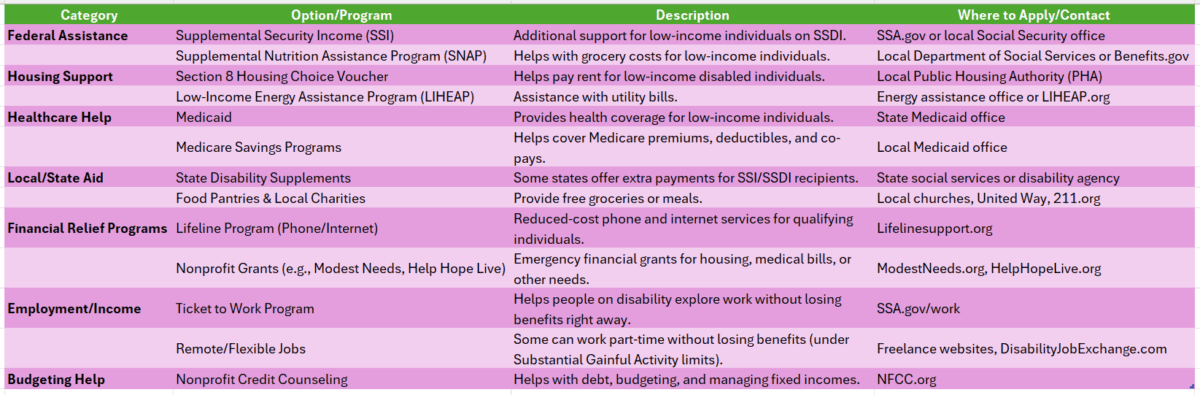

Explore Government Assistance Programs

In addition to your disability check, there are various government programs that can provide extra support. These may include food assistance, housing benefits, or healthcare programs. Research what’s available in your area to see if you qualify for any additional help.

Budgeting Tips When Your Disability Check Falls Short

When you rely on your disability check, it can be tough if you find that my disability check is not enough to cover your monthly expenses. Many people face this challenge, and it’s important to know that you’re not alone. Understanding how to budget effectively can help you stretch your funds further and make ends meet.

Track Your Spending

Start by keeping a record of where your money goes each month. This will help you identify areas where you can cut back. Consider using apps or a simple notebook to jot down your expenses. You might be surprised at how much small purchases add up!

Create a Realistic Budget

Once you know your spending habits, create a budget that reflects your needs. Prioritize essential expenses like housing, food, and healthcare. If permanent disability payments are your main source of income, make sure your budget aligns with that reality.

Can You Qualify for Supplemental Assistance Programs?

Many people rely on their disability checks to make ends meet. But what happens when your disability check is not enough? This situation can be stressful, especially if you have bills to pay and daily expenses. Fortunately, there are options available to help you bridge the gap.

If your permanent disability payments aren’t covering your needs, you might qualify for supplemental assistance programs. These programs are designed to provide extra financial support. Here are some options to consider:

- Supplemental Security Income (SSI): This program offers additional funds for those with limited income and resources.

- Food Assistance Programs: Programs like SNAP can help you afford groceries.

- Housing Assistance: Look into local housing programs that can help reduce your rent or utility costs.

- State and Local Programs: Many states offer additional support for individuals with disabilities.

Exploring these options can make a significant difference in your financial situation. Don’t hesitate to reach out for help; there are resources available to support you!

The Importance of Financial Planning for Disability Recipients

Relying on disability payments can be challenging, especially if your check isn’t enough to cover basic needs. Many people wonder, “What if my disability check is not enough?” Effective financial management is vital for those receiving permanent disability payments. Let’s discuss the importance of financial planning for disability recipients.

Understanding Your Financial Needs

Start by assessing your monthly expenses, including rent, utilities, groceries, and medical costs. Knowing your exact needs helps in planning. If your disability income falls short, consider:

- Budgeting: Track your spending with a budget.

- Assistance Programs: Research local programs that provide food or housing support.

Exploring Additional Income Sources

To supplement your income, consider:

- Part-time Work: Some jobs allow you to work without losing benefits.

- Freelancing: Utilize your skills for extra income.

- Community Resources: Look for grants or financial aid from organizations.

Planning ahead can significantly enhance your financial stability!

How to Advocate for a Higher Disability Payment

Many people rely on disability checks to make ends meet. However, if you find yourself saying, “My disability check is not enough,” you’re not alone. Understanding how to advocate for a higher payment can be crucial for your financial stability. Let’s explore some effective strategies to help you get the support you need.

Know Your Rights

It’s important to understand your rights regarding permanent disability payments. Familiarize yourself with the laws and regulations that govern disability benefits in your area. This knowledge can empower you to make informed decisions.

Gather Documentation

To strengthen your case, gather all necessary documentation. This includes:

- Medical records

- Employment history

- Financial statements

Having this information ready can help you present a strong argument for why your current payment isn’t sufficient.

Seek Professional Help

Consider reaching out to a disability advocate or attorney. They can provide guidance and support throughout the process. Remember, you deserve to receive the benefits that reflect your needs!

Exploring Community Resources: Where to Turn When Funds Are Low

When you rely on your disability check to cover your expenses, it can be tough if that check isn’t enough. Many people find themselves asking, What if my disability check is not enough? Understanding your options is crucial to making ends meet and maintaining your quality of life.

Local Assistance Programs

Many communities offer assistance programs designed to help those with permanent disability payments. These programs can provide food, housing, or utility assistance. Check with your local government or community center to find out what’s available.

Nonprofit Organizations

Nonprofits often have resources for individuals facing financial hardships. Organizations like food banks or charities can help fill in the gaps. They can offer everything from groceries to financial counseling, making it easier to manage your budget.

Ready to connect with top legal professionals? Get immediate support— Call us at 833-248-4565.

Creative Solutions: Side Gigs for Disabled Individuals

When your disability check isn’t enough, it can feel overwhelming. Many individuals rely on their permanent disability payments to cover basic needs, but sometimes, these payments just don’t stretch far enough. Thankfully, there are creative solutions to help bridge the gap and improve your financial situation.

Consider exploring side gigs that fit your skills and interests. Here are some ideas:

- Freelancing: Use your talents in writing, graphic design, or programming to earn extra cash online.

- Online Tutoring: If you excel in a subject, share your knowledge with students through virtual tutoring sessions.

- Crafting or Selling: If you’re crafty, consider selling handmade items on platforms like Etsy. These options can help supplement your income when your disability check is not enough. Remember, every little bit helps, and finding the right side gig can make a big difference in your financial well-being.

Read Also: How to Get Disability for Mental Illness: A Complete Guide

Navigating the Emotional Impact of Financial Strain

When you rely on a disability check, it can be tough to make ends meet. If your disability check is not enough, it’s essential to understand that you’re not alone. Many people face similar challenges, and it’s okay to seek help and explore options. Financial strain can lead to stress and anxiety, affecting your overall well-being.

Acknowledge Your Feelings

Feeling overwhelmed is normal. Recognizing that your permanent disability payments may not cover all your expenses is the first step. It’s okay to feel frustrated or scared. Talking about these feelings with friends or family can help lighten the load.

Explore Additional Resources

Consider looking into community resources or government assistance programs. Here are some options:

- Food assistance programs

- Housing subsidies

- Local charities that offer financial aid These resources can provide a safety net when your disability check isn’t enough, helping you regain some peace of mind.

How FreeLegalCaseReview Can Help You Find Financial Relief

Many people rely on their disability checks to cover essential expenses. But what happens when your disability check is not enough? This situation can be overwhelming, leaving you feeling stressed and uncertain about your financial future. Thankfully, there are options available to help you find relief.

Explore Additional Resources

- Financial Assistance Programs: FreeLegalCaseReview can guide you to local and federal programs designed to supplement your permanent disability payments.

- Budgeting Tools: Learn how to manage your finances better with tools and tips provided by FreeLegalCaseReview.

Connect with Experts

- Consultation Services: Get in touch with financial advisors who specialize in disability income. They can help you explore all your options.

- Community Support: Join forums and groups through FreeLegalCaseReview where you can share experiences and find support from others in similar situations.

Don’t wait to secure the legal representation you deserve. Visit FreeLegalCaseReview today for free quotes and tailored guidance, or call 833-248-4565 for immediate assistance.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

1. Why is my disability check so low?

Your disability benefit amount is based on your average lifetime earnings before your disability began. If you had low earnings or limited work history, your check may be smaller. SSI benefits are also need-based and capped at federal and state levels.

2. Can I get additional financial help if my disability check isn’t enough?

Yes. You may qualify for programs like Supplemental Nutrition Assistance Program (SNAP), housing assistance, Medicaid, utility assistance (LIHEAP), or local non-profits that provide support to people with disabilities.

3. Can I work while receiving disability benefits to supplement my income?

Yes, under certain conditions. Social Security has work incentive programs like Ticket to Work or the Trial Work Period that allow you to test employment without losing benefits immediately. Be sure to report income to avoid overpayments.

4. Am I eligible for other types of disability benefits in addition to SSDI or SSI?

You may be eligible for VA disability benefits (if you’re a veteran), long-term disability insurance (if you had a policy), or workers’ compensation (if your disability was job-related).

5. Can I get more money if my condition has worsened?

Possibly. If your disability has become more severe, you can request a review and may qualify for increased support or additional programs depending on your circumstances.

6. How do I appeal if I think my benefit amount is incorrect?

You can request a reconsideration or appeal through the Social Security Administration. It’s best to consult with a disability lawyer or advocate to strengthen your case.