What Are the Best Ways to Settle Credit Debt? A Guide

Looking for trusted legal experts to handle your case? Whether it’s a complex claim or a personal issue, FreeLegalCaseReview offers free consultations and expert advice tailored to your needs. Or call us directly at 833-248-4565.

Understanding Settle Credit Debt is crucial for your financial health. It impacts your credit score, limits your financial freedom, and can lead to stress. Many individuals, like Sarah, a young professional, find themselves overwhelmed by multiple credit cards and struggling to make minimum payments, which only increases their debt. Addressing credit card debt is essential, and here are some effective strategies to consider:

- Create a Budget: Track your income and expenses to identify areas to cut back and allocate more funds toward debt repayment.

- Prioritize Payments: Use the avalanche method to focus on paying off high-interest debts first, saving you money in the long run.

- Negotiate with Creditors: Contact your credit card company to discuss lower interest rates or payment plans.

- Consider Professional Help: If overwhelmed, consult a lawyer for foreclosure house or a financial advisor for tailored guidance.

- Explore Debt Settlement Options: Look into negotiating to settle private student loans or credit card debts for less than what you owe.

By understanding credit card debt and implementing these strategies, you can take control of your financial future. Remember, achieving financial freedom is a marathon, not a sprint. With patience and the right approach, you can manage your debts and regain peace of mind.

Top Strategies to Settle Credit Card Debt Effectively

Tackling credit card debt requires understanding your options. Many feel overwhelmed, but effective strategies exist to help you regain control of your finances. One popular method is negotiating directly with your credit card issuer. By explaining your situation, you might secure a lower interest rate or a reduced balance.

For example, a friend reduced her debt by 30 percent with just a phone call. It’s definitely worth trying! Another option is to engage a debt settlement company. These professionals can negotiate on your behalf, often achieving better results than you could alone. Ensure you choose a reputable company to avoid scams; look for those with positive reviews and a solid track record. If you face foreclosure, consulting a lawyer for foreclosure house issues can help protect your assets while managing debts. If you have private student loans, consider how to settle them effectively.

Some lenders offer hardship programs that can lower your payments or allow you to settle for less than owed. Always explore these options. Remember, you are not alone in this journey. By taking proactive steps and seeking help when needed, you can navigate your way out of credit card debt and move towards financial freedom.

How to Negotiate with Creditors for Debt Settlement

Negotiating with creditors is one of the most effective strategies for settling credit card debt. While it may seem intimidating, a well-prepared approach can help you significantly reduce your debt. Begin by gathering all relevant information about your accounts, such as balances, interest rates, and payment history. This preparation demonstrates to creditors that you are serious about resolving your debt. Here are some essential steps to follow when negotiating with creditors:

- Contact Your Creditors: Reach out directly and explain your situation honestly. Be polite yet firm, expressing your desire to find a solution.

- Propose a Settlement Amount: Offer a lump sum that is less than your total debt. Many creditors may accept a lower amount if it seems beneficial for them.

- Get Everything in Writing: If a creditor agrees to a settlement, obtain written confirmation to protect yourself from future claims for the remaining balance.

- Consider Professional Help: If negotiations feel overwhelming, hiring a lawyer for foreclosure house or a debt settlement professional can provide valuable support.

They can negotiate on your behalf and help navigate the complexities of debt settlement. By following these steps, you can effectively settle credit card debt and even tackle private student loans, aiming for a mutually beneficial agreement that alleviates your financial stress.

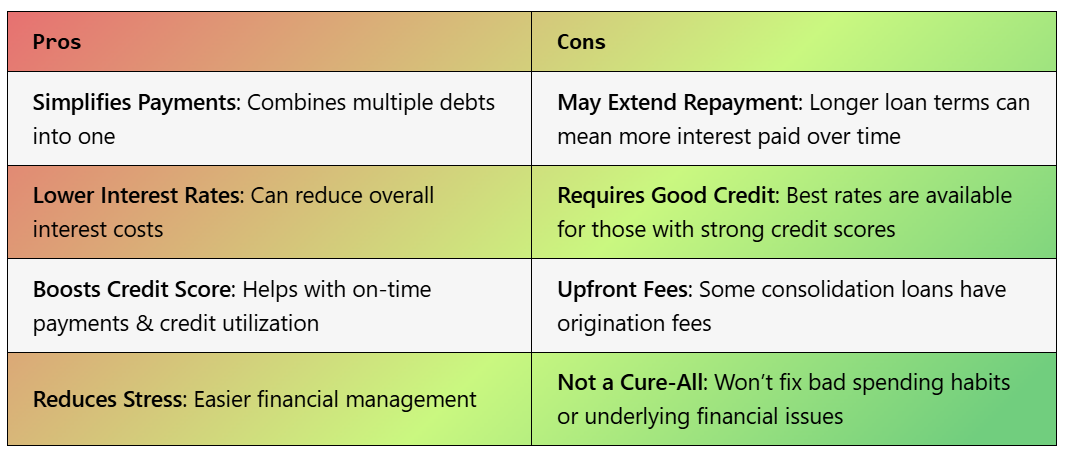

Exploring Debt Consolidation as a Solution

Debt consolidation is a powerful strategy for settling credit card debt that many overlook. By combining multiple debts into a single loan, you simplify your payments and may even lower your interest rates. Picture this: just one monthly payment instead of several, which can significantly reduce stress and help you regain financial control. Consider these benefits of debt consolidation:

- Simplified Payments: One loan means one due date, reducing the risk of late fees.

- Lower Interest Rates: Qualifying for a lower rate can save you money over time.

- Improved Credit Score: Lowering your credit utilization ratio can enhance your credit score.

To embark on your debt consolidation journey, follow these steps:

- Assess Your Debt: Compile a list of all your debts, noting balances and interest rates.

- Research Options: Explore personal loans, balance transfer credit cards, or consult a lawyer for foreclosure house if you’re in dire financial straits.

- Choose the Right Plan: Pick a consolidation method that aligns with your financial situation. If you have private student loans, look into settling those as well to further alleviate your debt burden.

By considering debt consolidation, you take a proactive step toward settling credit card debt and securing a more stable financial future.

The Role of Credit Counseling in Settling Debt

Settling credit card debt can be daunting, but many overlook the valuable resource of credit counseling. Credit counselors are trained professionals who assist you in navigating financial challenges and creating a personalized debt management plan. They offer insights into budgeting and can negotiate with creditors on your behalf, which is especially helpful if you are also facing issues like foreclosure or private student loans. Here are some key benefits of working with a credit counselor:

- Expert Guidance: They possess extensive knowledge of debt management strategies tailored to your unique situation.

- Negotiation Skills: Counselors can negotiate with creditors to lower interest rates or settle credit debt for less than owed.

- Emotional Support: Managing debt can be stressful, and a credit counselor provides the emotional support needed during tough times.

To begin credit counseling, follow these steps:

- Research: Find reputable credit counseling agencies in your area and check their credentials.

- Schedule a Consultation: Most agencies offer a free initial consultation to discuss your financial situation.

- Create a Plan: Collaborate with your counselor to develop a personalized debt management plan addressing your credit card debt and other obligations.

In summary, credit counseling is a powerful tool for settling credit card debt, helping you move toward financial freedom.

Using a Balance Transfer to Manage Credit Card Debt

Using a balance transfer to manage credit card debt is a savvy strategy for regaining financial control. This involves moving your existing credit card balances to a new card with a lower interest rate, often featuring an introductory 0 percent APR for a limited time.

This approach can significantly cut down on interest payments, allowing you to focus on reducing the principal. For instance, if you have five thousand dollars in credit card debt at a high interest rate, transferring that balance to a card with no interest for twelve months can save you hundreds in interest fees. Benefits of using a balance transfer include:

- Lower Interest Rates: Save on interest payments, making debt repayment easier.

- Simplified Payments: Consolidate multiple debts into one monthly payment, reducing management stress.

- Time to Pay Off Debt: The introductory period gives you a clear timeline to eliminate debt without accruing more interest.

However, be cautious of potential fees and ensure you pay off the balance before the promotional period ends to avoid higher rates.

To effectively use a balance transfer, follow these steps:

- Research Options: Find credit cards with the best balance transfer offers.

- Check Your Credit Score: A higher score can lead to better rates.

- Calculate Costs: Ensure savings from lower interest exceed any transfer fees.

- Create a Payment Plan: Budget to pay off the transferred balance before the promotional period ends.

By strategically utilizing a balance transfer, you can settle credit card debt and work towards a healthier financial future.

Ready to connect with top legal professionals? Get immediate support— Call us at 833-248-4565.

Creating a Budget to Pay Off Credit Card Debt

Creating a budget to pay off credit card debt is a highly effective strategy. It helps you track spending and ensures you allocate enough funds to settle your debts. Start by listing all income sources and monthly expenses to get a clear picture of your finances.

For example, if you earn three thousand dollars a month and your essential expenses total two thousand dollars, you have a thousand dollars left to allocate towards credit card payments. Next, prioritize your debts by focusing on high-interest credit cards first, as they cost you more over time. You can use the snowball method, paying off the smallest debts first for motivation, or the avalanche method, tackling the highest interest rates first. Both methods have their advantages, depending on your personal motivation. Here are some benefits of creating a budget for debt repayment:

- Clarity: Understand where your money goes each month.

- Control: Take charge of your finances and reduce stress.

- Progress Tracking: Monitor how quickly you can settle credit debt and celebrate small victories along the way.

Lastly, consider seeking professional help if needed. A lawyer for foreclosure house issues or a financial advisor can provide tailored insights. If you have private student loans, exploring options to settle private student loans can also ease financial pressure. The goal is to create a sustainable budget that helps you pay off debts while enjoying life without constant financial worry.

Read Also: When Should You Hire a Foreclosure Defense Lawyer?

The Benefits of Professional Debt Settlement Services

Settling credit card debt can be overwhelming, but one effective option is to utilize professional debt settlement services. These experts provide guidance and support, helping you navigate the complexities of debt management. By collaborating with professionals, you can negotiate lower payments and potentially reduce the total amount owed, making it a viable solution for those struggling with credit card bills. Here are some key benefits of using professional debt settlement services:

- Expert Negotiation: Professionals have the experience to negotiate better settlement offers with creditors.

- Stress Reduction: Having a team manage negotiations allows you to focus on other aspects of your life, reducing stress.

- Customized Plans: Services tailor their approach to your unique financial situation, ensuring optimal outcomes.

- Potential for Lower Payments: Many clients successfully settle private student loans or credit card debts for significantly less than owed, providing immediate relief. Real-world examples highlight the effectiveness of these services.

For instance, a client burdened by credit card debt worked with a debt settlement lawyer who negotiated a settlement that cut their debt by nearly fifty percent. This not only eased their financial strain but also helped them avoid foreclosure on their house. If you are considering settling your debts, exploring professional services could be a crucial step towards financial stability.

Common Mistakes to Avoid When Settling Credit Card Debt

Settling credit card debt can be challenging, and many individuals fall into common traps that hinder their progress. One major mistake is not fully understanding the terms of their debt. Jumping into negotiations without knowing the total outstanding balance or interest rates can lead to unfavorable settlements that do not alleviate the burden. It is essential to gather all relevant information before discussing options with creditors. Another frequent error is avoiding communication with creditors due to fear or embarrassment.

However, creditors are often willing to negotiate if you reach out proactively. For instance, a friend successfully settled a significant portion of their debt by explaining their financial situation, discovering that the creditor was open to a reduced payment plan. Being honest and upfront can lead to more favorable outcomes.

Lastly, consider the long-term implications of settling your debt. While settling quickly may seem appealing, it is crucial to think about how it will affect your credit score. Settling credit card debt can impact your credit report, so consulting with a financial advisor or a lawyer for foreclosure house situations can provide valuable insights. By avoiding these common mistakes, you can navigate the debt settlement process more effectively and work towards a brighter financial future.

Don’t wait to secure the legal representation you deserve. Visit FreeLegalCaseReview today for free quotes and tailored guidance, or call 833-248-4565 for immediate assistance.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

-

What does it mean to settle credit debt?

Debt settlement is an agreement between you and a creditor to pay less than the full amount owed as a way to resolve the debt. -

How does debt settlement affect my credit score?

Settling debt can negatively impact your credit score because it shows that you didn’t pay the full amount. However, it can be better than continuing to miss payments or declaring bankruptcy. -

What types of debt can be settled?

Typically, unsecured debts like credit card debt, medical bills, and personal loans can be settled. Secured debts like mortgages and car loans are harder to settle. -

Is debt settlement the same as debt consolidation?

No. Debt consolidation combines multiple debts into one loan with a lower interest rate, while debt settlement reduces the actual amount you owe.