When Do You Need a Student Loan Attorney Issues?

Looking for trusted legal experts to handle your case? Whether it’s a complex claim or a personal issue, FreeLegalCaseReview offers free consultations and expert advice tailored to your needs. Or call us directly at 833-248-4565.

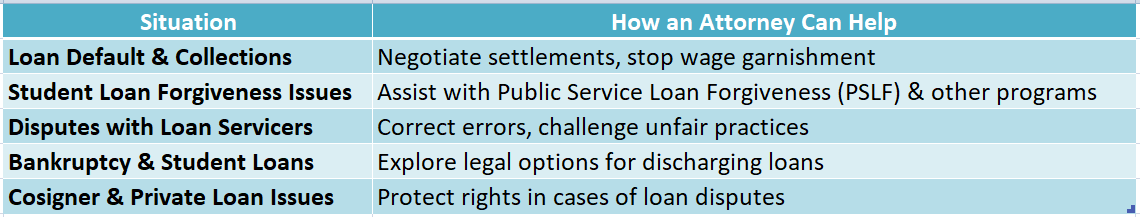

Understanding student loan issues can be daunting for many borrowers. Knowing when to consult a Student Loan Attorney can significantly impact your financial future. Here are key situations where legal help is essential.

When to Seek Help from a Student Loan Attorney

- Loan Disputes: If your loan servicer is making errors, an attorney can help resolve these issues effectively.

- Default Situations: Falling behind on payments can lead to default. An attorney can guide you through options to avoid severe consequences.

- Fraud or Misrepresentation: If you suspect fraud in your loan process, legal advice is crucial to protect your rights.

Benefits of Consulting a Student Loan Attorney

- Expert Guidance: They understand complex student loan laws and provide tailored advice.

- Negotiation Skills: An attorney can negotiate better repayment terms or settlements on your behalf.

- Peace of Mind: Having a professional on your side can relieve stress and help you focus on your education.

Understanding Your Rights

A Student Loan Attorney can clarify your rights as a borrower, which is vital if you feel overwhelmed by the loan process.

Navigating Repayment Plans

If you’re unsure about which repayment plan to choose, a lawyer can help clarify your options and select a plan that fits your financial situation.

Handling Collections

If your loans are in collections, a Student Loan Attorney can negotiate with collectors to find a workable solution.

Exploring Forgiveness Programs

Many borrowers qualify for forgiveness programs, and an attorney can help you navigate these options to ensure you meet all requirements.

Signs You Need Legal Help with Student Loans

Navigating student loans can feel like wandering through a maze. Sometimes, you might hit a wall and wonder if you need help. Understanding when to seek a Student Loan Attorney is crucial. They can guide you through the complexities and help you make informed decisions.

- You’re Facing Default: If you’re struggling to make payments and fear defaulting, it’s time to consult a lawyer. They can help you explore options like deferment or income-driven repayment plans.

- Your Loan Servicer is Unresponsive: If your loan servicer isn’t providing clear answers or is ignoring your requests, a Student Loan Attorney can step in to advocate for you.

- You’re Being Sued: If you receive a lawsuit regarding your student loans, don’t wait. A lawyer can help you understand your rights and options to defend yourself.

- You’re Considering Bankruptcy: Student loans can complicate bankruptcy. A lawyer can help you navigate this tricky situation and determine if it’s a viable option for you.

In these situations, having a Student Loan Attorney by your side can make a significant difference. They can help you understand your rights and options, ensuring you don’t feel lost in the process.

Navigating Default: Do You Need a Lawyer?

When it comes to student loans, many borrowers find themselves overwhelmed and unsure of their next steps. Understanding when to seek help from a student loan attorney can make a significant difference in your financial future. If you’re facing challenges like default or harassment from lenders, knowing when to get legal advice is crucial.

Signs You Might Need a Lawyer

- You’re in Default: If you’ve missed payments and your loan is in default, a student loan attorney can help you explore options to get back on track.

- Harassment from Collectors: If you feel overwhelmed by aggressive collection tactics, legal support can protect your rights.

- Confusing Paperwork: If the paperwork and options seem confusing, an attorney can help clarify your choices and guide you through the process.

Benefits of Hiring a Student Loan Attorney

- Expert Guidance: They understand the laws and can provide tailored advice.

- Negotiation Skills: An attorney can negotiate with lenders on your behalf, potentially reducing your debt.

- Peace of Mind: Knowing you have a professional on your side can relieve stress and help you focus on your future.

In summary, if you’re struggling with student loan issues, don’t hesitate to reach out for help. A student loan attorney can be your ally in navigating the complexities of your situation, ensuring you make informed decisions for a brighter financial future.

The Role of a Student Loan Attorney in Bankruptcy

When it comes to student loans, many people feel overwhelmed and unsure of their options. This is especially true when financial difficulties arise. Understanding when to seek help from a Student Loan Attorney can make a significant difference in your situation. Let’s explore how a student loan attorney can assist you, especially in bankruptcy cases.

A Student Loan Attorney specializes in navigating the complex world of student loans. They can help you understand your rights and options, especially if you’re considering bankruptcy. Here are some key reasons to consult one:

When to Seek Help:

- Facing Default: If you’re struggling to make payments, a lawyer can help you explore alternatives.

- Considering Bankruptcy: Student loans can be tricky in bankruptcy. An attorney can guide you through the process and help determine if your loans can be discharged.

- Disputing Loan Servicer Actions: If you believe your loan servicer is acting unfairly, an attorney can advocate on your behalf.

In summary, knowing when to reach out to a Student Loan Attorney is crucial. They can provide valuable insights and support, ensuring you make informed decisions about your financial future.

Ready to connect with top legal professionals? Get immediate support— Call us at 833-248-4565.

Can a Lawyer Help You with Loan Forgiveness Programs?

Navigating student loans can feel like wandering through a maze. With so many options and programs available, it’s easy to get lost. That’s where a Student Loan Attorney can step in to help you find your way, especially when it comes to loan forgiveness programs. Understanding when to seek legal help is crucial for your financial future.

A Student Loan Attorney can provide valuable guidance on various loan forgiveness programs. Here are some key points to consider:

- Eligibility Check: They can help determine if you qualify for programs like Public Service Loan Forgiveness (PSLF).

- Application Assistance: Filling out forms can be tricky. An attorney can ensure your application is complete and accurate, increasing your chances of approval.

- Dispute Resolution: If your application is denied, a lawyer can assist in appealing the decision, advocating for your rights.

In short, if you’re feeling overwhelmed by student loan issues, especially regarding forgiveness, reaching out to a Student Loan Attorney can be a smart move. They can help you navigate the complexities and make the process smoother, allowing you to focus on your education and future.

Read Also: When Should You Hire a Foreclosure Defense Lawyer?

How to Choose the Right Student Loan Attorney for Your Needs

When it comes to student loans, knowing when to seek help from a lawyer can be crucial. Many students and graduates face challenges like overwhelming debt, confusing repayment plans, or even loan forgiveness options. A Student Loan Attorney can guide you through these issues, ensuring you make informed decisions about your financial future.

Choosing the right Student Loan Attorney is essential. Here are some tips to help you find the best fit for your situation:

Look for Experience

- Check their background: Ensure they specialize in student loans and have a track record of success.

- Read reviews: Look for testimonials from previous clients to gauge their effectiveness.

Understand Their Fees

- Ask about costs: Some attorneys charge by the hour, while others may have flat fees.

- Inquire about payment plans: Make sure you understand how and when you’ll pay for their services.

Schedule a Consultation

- Meet in person or virtually: This helps you assess their communication style and expertise.

- Prepare questions: Ask about their approach to your specific issues and how they can help you navigate the complexities of student loans.

How FreeLegalCaseReview Can Support You in Student Loan Challenges

Navigating student loans can be overwhelming, leading many to wonder, “When do I need a lawyer for student loan issues?” This question is important, as the right legal support can significantly impact your financial future. Knowing when to seek help can save you time, money, and stress.

Signs You Might Need a Student Loan Attorney

- Facing Default: If you’re struggling to make payments, a lawyer can help you explore options.

- Loan Disputes: If you feel your loan servicer is treating you unfairly, legal advice can clarify your rights.

- Bankruptcy Considerations: If bankruptcy is on your mind, a student loan attorney can guide you through discharging loans.

Benefits of Hiring a Student Loan Attorney

- Expert Guidance: They understand the laws and can provide tailored advice.

- Negotiation Skills: Attorneys can negotiate better terms with lenders for you.

- Stress Relief: Having a professional handle your case can ease your anxiety.

Steps to Take

- Assess Your Situation: Determine if your issues warrant legal help.

- Research Attorneys: Look for a student loan attorney with good reviews.

- Schedule a Consultation: Many offer free initial consultations to discuss your case.

In conclusion, knowing when to seek help is crucial. A student loan attorney can be your ally, helping you navigate complexities and find a path forward.

Don’t wait to secure the legal representation you deserve. Visit FreeLegalCaseReview today for free quotes and tailored guidance, or call 833-248-4565 for immediate assistance.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

-

What is a student loan attorney?

A student loan attorney is a legal professional who specializes in helping borrowers with student loan-related issues, including repayment, disputes, default, and loan forgiveness. -

When should I consider hiring a student loan attorney?

You should consider hiring one if you’re facing loan default, wage garnishment, legal action, or difficulties negotiating repayment plans. -

How can a student loan attorney help me?

They can assist with loan disputes, negotiate with lenders, help with loan forgiveness applications, and represent you in court if necessary. -

Do student loan attorneys only help with federal loans?

No, they can assist with both federal and private student loans.

-

Can a student loan attorney help me get my loans forgiven?

They can guide you through loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) forgiveness. -

What can I do if I’m being sued for my student loan debt?

A student loan attorney can defend you in court, negotiate a settlement, or challenge the lawsuit if there are legal errors.